Our Projects are

Transforming African Trade

Quick Contacts

2nd Floor, Fidelity Insurance Centre Waiyaki Way, Westlands

Last month, Mastercard announced a partnership with Samsung, Airtel Africa and Asante Financial Services Group to launch a Pay-on-Demand payments platform and drive the digital economy across Africa.

By enabling digital access to everyday products and services for under-served consumers and micro, small and medium enterprises (MSMEs), the continent could experience positive economic growth covering even the poorest which has been elusive for decades.

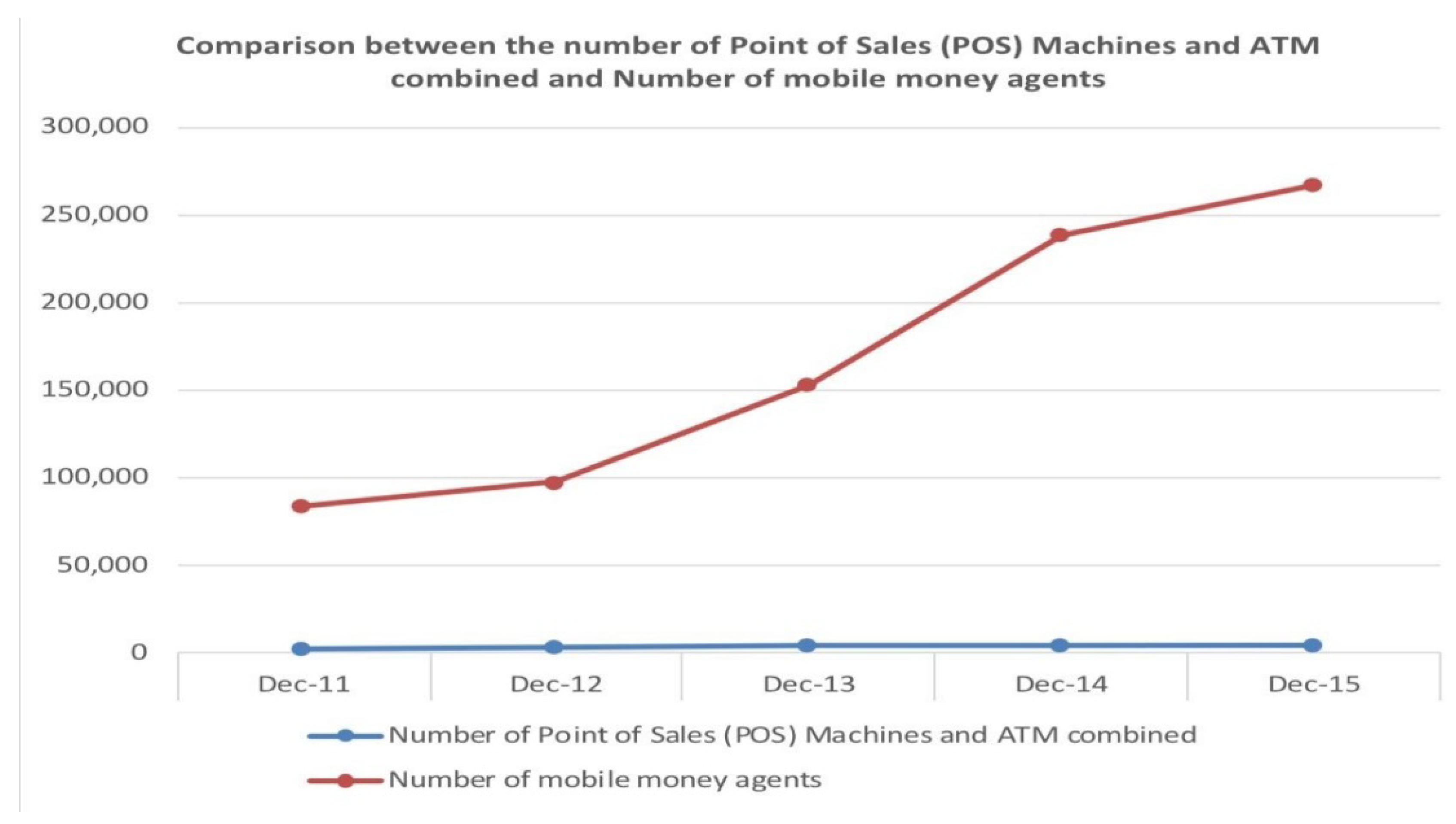

The International Finance Corporation (IFC) notes that the launch and growth of digital financial services has led to an unprecedented increase in the number of people enjoying access to formal financial services.

Today, Africa has more digital financial services deployments than any other region in the world, with almost half of the nearly 700 million individual users worldwide.

Mobile money solutions and agent banking remain the most preferred since they now offer affordable, instant, and reliable transactions, savings, credit, and even insurance opportunities in rural villages and urban neighbourhoods even without bank branches.

This, quite literally, banking at your fingertips – is for everyone and it has revolutionised how transactions are carried out. The impact of this convenience is that it extends beyond the individual since the impact can be felt across society.

“Ten years after the breakthrough of digital financial services in Sub-Saharan Africa, we are seeing evidence of this. Field studies show that access to mobile money services has increased daily per capita consumption levels of households, lifting them out of extreme poverty,” notes Reeta Roy who is the President and CEO of Mastercard Foundation and Philippe Le Houérou, the IFC CEO.

It is with this knowledge and the opportunities therein that Mastercard aims at driving digital and financial inclusion for better economic possibilities for people and businesses.

Mastercard’s strategy is based on collaboration and partnerships that drive innovation and this platform, built by Mastercard Labs, aims to bring convenient financing opportunities to consumers, entrepreneurs and merchants across Africa, helping to combat the socio-economic problems they face from restricted access to financing.

Through Samsung’s pay-on-demand mobile devices and Asante’s insight as a leading provider of digital financial services, the innovative platform provides effective handset loans for consumers.

Telecommunications and mobile money services provider, Airtel Africa will coordinate the delivery of the product.

Mobile money services have changed lives and the IFC notes that for instance, women have moved from subsistence farming to business occupations and sustainable livelihoods.

Financial inclusion is a catalyst for equitable development and inclusive economic growth and the continent could benefit immensely from its expansion.

In a 2019 report titled, “DIGITAL ACCESS: The Future of Financial Inclusion in Africa”, there are several opportunities and challenges in furthering financial inclusion.

For ease of adoption of the Mastercard platform, the Samsung devices are embedded with Samsung Knox platform which provides a secure environment for corporate data and apps protecting both business and personal privacy from boot-up, runtime, and even when powered off.

The companies say that their partnership will help to deliver convenient asset financing to consumers and MSMEs through the convenience of their smart handsets at a low upfront cost while distributing payments over time.

As the product is used, importantly, the individual or business will establish a digital transaction history, which can be leveraged for making other financing solutions accessible, such as credit, savings, investments and insurance.

For small business owners and entrepreneurs, this is particularly beneficial as it offers an opportunity to obtain financing to drive their business forward as well as build digital capabilities for their everyday business.

It is envisaged that Pay-on-Demand users will also be able to access digital payments through Mastercard’s virtual card and Mastercard Quick Response (QR Codes) functionality on their Airtel mobile money app enabling them to make digital transactions across face to face and online merchants.

There are 14 markets being considered across Africa, piloting first in Uganda in October, subject to regulatory approvals.

This partnership builds on the broader digital transformation partnership between Mastercard and Airtel Africa across sub-Saharan Africa.

The other markets include Tanzania, Rwanda, Kenya, Nigeria, DRC, Gabon, Malawi, Zambia, Madagascar, Seychelles, Chad, Niger and Congo Brazzaville. This partnership also builds on the global partnership with Samsung to provide Pay-on-Demand mobile devices.

For the continent’s financial inclusion ambitions, the missing link is not technology but the willingness of players to accommodate the most locked out.

As it is, poorer people are more concerned about their lack of money while more educated people are more concerned about cost and trust in the banking (finance) systems. If service providers and other stakeholders are able to accommodate all these needs and worries, then Africa may be on its way to financial prosperity that has remained elusive for decades.

Read original article

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TradeMark Africa.