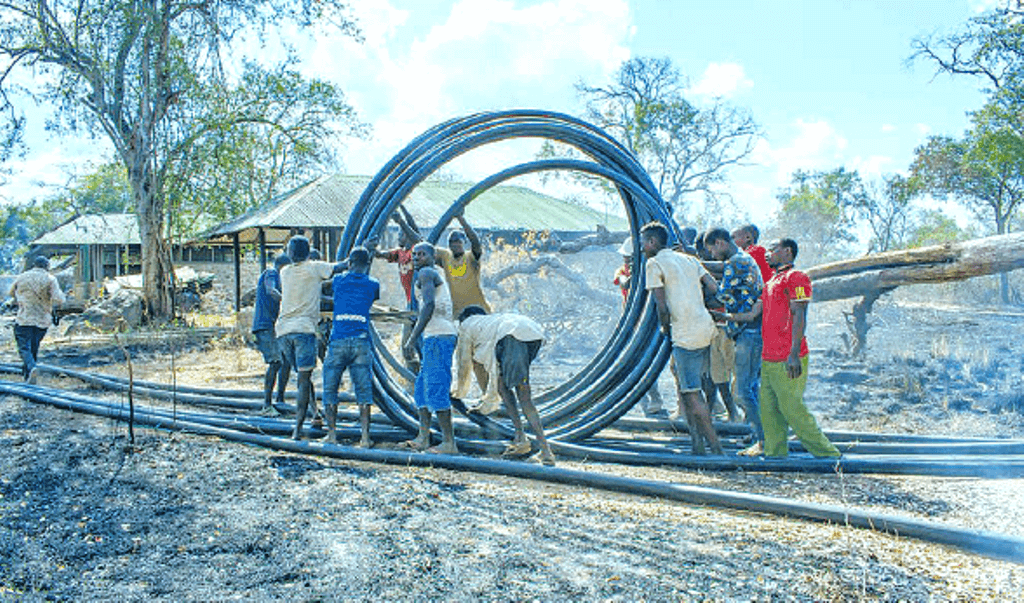

Speaking at an EAC high level EA business and investment summit held in Arusha this week, Serengeti Breweries Limited’s Managing Director, Mark Ocitti whose company is currently investing 14 million pounds (over 40bn/-) in expansion of its three brewing plants in the country, said the bloc’s tax regimes are not business friendly. Giving his views at a plenary session entitled, ‘Tax regime harmonization-fears, benefits and practical way forward’, Ocitti said, “The list of stays of implementation continue to grow due to concerns in terms of economic asymmetry between EAC member states in terms of revenue considerations, support for infant industries; affordability, high quality and sufficient availability of inputs, focus on growing competitive upstream industries and supply of high quality products at affordable prices for consumers.” Ocitti called for speedy tax harmonization among the EAC members saying that though some significant ground has been covered, the prevailing barriers to trade needed to be quickly managed in order to have a steady flow of investment and free movement of goods and services. “Vehicles such as duty remission schemes continue to play a crucial role in supporting manufacturing in EAC,” Ocitti argued while noting that different interpretation of the EAC Treaty’s article terms such as ‘import’ by the members has led to the higher domestic taxes charged on goods originating the bloc, a protectionist move that has lowered intra-EAC trade. Explaining on the impact of the current state on the brewing industry, the SBL chief executive noted that differences in the domestic taxation...

SBL over 40bn/- industrial expansion pleads harmonization of EAC taxes

Posted on: December 2, 2019

Posted on: December 2, 2019