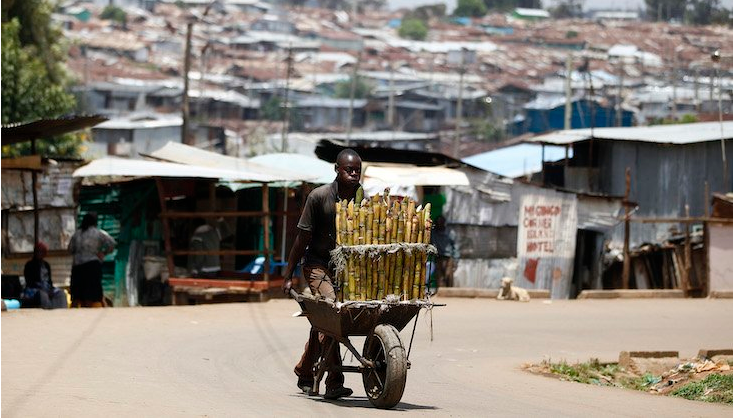

First international digital road freight platform to be launched in the continent; Provides shippers and carriers a one-stop platform for road freight connections for domestic shipments within South Africa and international movements to several neighbouring countries; Further expansion to connect shippers and carriers within Sub-Saharan Africa (SSA) is planned for early 2020. Digital freight forwarder Saloodo! a subsidiary of DHL Global Forwarding, the leading international provider of air, sea and road freight services, today launched its digital logistics platform for shippers and transport providers in South Africa, bringing the first digital road freight solution to the region. An efficient road freight network is a key conduit of trade within a geographically wide-spread country such as South Africa but also with 16 landlocked countries within Sub-Saharan Africa (SSA). However, much of the region’s road freight operations remain fragmented and highly traditional, missing out on the visibility, efficiency and security that logistics technology offers. “Digital transformation is a top priority for the industry and given the demographics, we expect demand for digital transformation to be driven by emerging markets globally,” said Tobias Maier, CEO of Saloodo! Middle East and Africa. “Africa is the world’s youngest continent with 60% of the continent below 25. This is a dynamic generation of digitally-minded young adults, demanding smart, digital solutions both on the business and home front.” With South Africa as its launch pad into Sub-Saharan Africa, Saloodo! is the first digital logistics platform available in the region that offers a single, simple and reliable interface...

Road freight in Sub-Saharan Africa goes digital with DHL’s Saloodo!

Posted on: November 20, 2019

Posted on: November 20, 2019