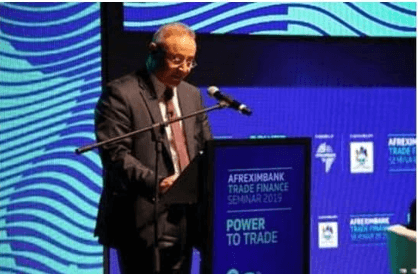

The African Development Bank (AfDB) will use its newly ramped-up capital base to help boost private sector investment on the continent and invest in infrastructure projects that support the African Continental Free Trade Area (AfCFTA). These are some of the plans the bank has for the additional $115bn (R1.7-trillion) recently approved by its shareholders, according to the bank’s vice-president for finance and CFO, Bajabulile “Swazi” Tshabalala. At the end of October, the bank’s shareholders agreed to more than double its capital base, the largest increase in the bank’s history, taking the total to $208bn. “We are looking to do more private sector activities and investments in support of the African continental free trade agreement because you need companies to actually trade with each other,” she said. The bank will also ramp up efforts to support African entrepreneurs, particularly women and young people. Tshabalala was speaking on the sidelines of the Africa Investment Forum, which closed in Johannesburg on Wednesday. The forum is designed as a deal-making platform and marketed 56 transactions from across the continent to international and regional investors. Investment interest was secured for deals worth $40.1bn, up from the previous year’s $38.7bn. The capital boost will provide the bank with “additional risk capacity” to support and crowd in investment by the private sector, particularly in low-income and fragile countries that have been neglected in the past, she said. This will include the use of instruments that help mitigate risks for private investors, including the bank’s co-guarantee platform. The...

African Development Bank has $115bn more for projects on the continent

Posted on: November 15, 2019

Posted on: November 15, 2019